Automate your trading with real-time forex signals delivered straight to your account.

How it works

We make every step intuitive, efficient, and reliable.

Establish Connection

The leading cross-platform trade copier send trades from master to slave accounts and sync trades instantly across all the accounts.

Cloud Based

Our software runs 100% in the cloud, there's no software to download, no EA's to install, and no VPS required.

Equity Protection

Our equity protection is extremely reliable. The second we see your equity fall below your set limits, we'll take action.

Establish Connection

The leading cross-platform trade copier send trades from master to slave accounts and sync trades instantly across all the accounts.

Cloud Based

Our software runs 100% in the cloud, there's no software to download, no EA's to install, and no VPS required.

Equity Protection

Our equity protection is extremely reliable. The second we see your equity fall below your set limits, we'll take action.

Low Latency

20-30 ms

Dedicated Environment

All Brokers &

Platforms

Flexible Money

Management

Trading

Filters

Trading strategies

Proven trading methods built for consistent performance.

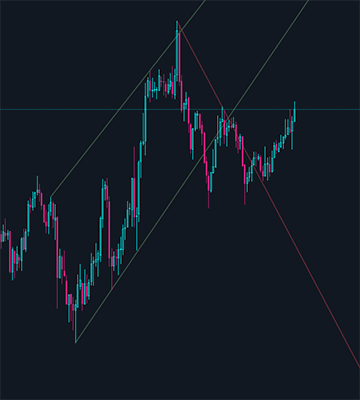

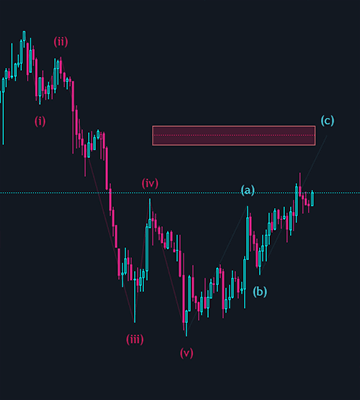

BLACK BOX TRADING SYSTEM

Structural Complexity

Structural complexity in trading arises when decisions come from an interconnected system of multiple strategies, signals, constraints, and execution rules rather than a single alpha. Outcomes emerge from how these components interact, adapt to regimes, and respond to risk and feedback loops. Performance and risk are therefore non-linear, path-dependent, and difficult to attribute to any one strategy.

Trading USDJPY Only

12-15 Swing Trades/month

53% Profit Trades

Max Two Open Trades

Duration is over 3 days

No Hedging, Martingale

Risk management

Focused on preserving equity while maximizing consistency.

Risk Adjustments

Our trade copier is built with dynamic risk adjustments that respond to market volatility, performance metrics, and price behavior.

Personalized Risk

Every trader has a different risk tolerance. That’s why our copier allows you to fully personalize your risk settings.